Introduction to Investment Portfolio Diversification

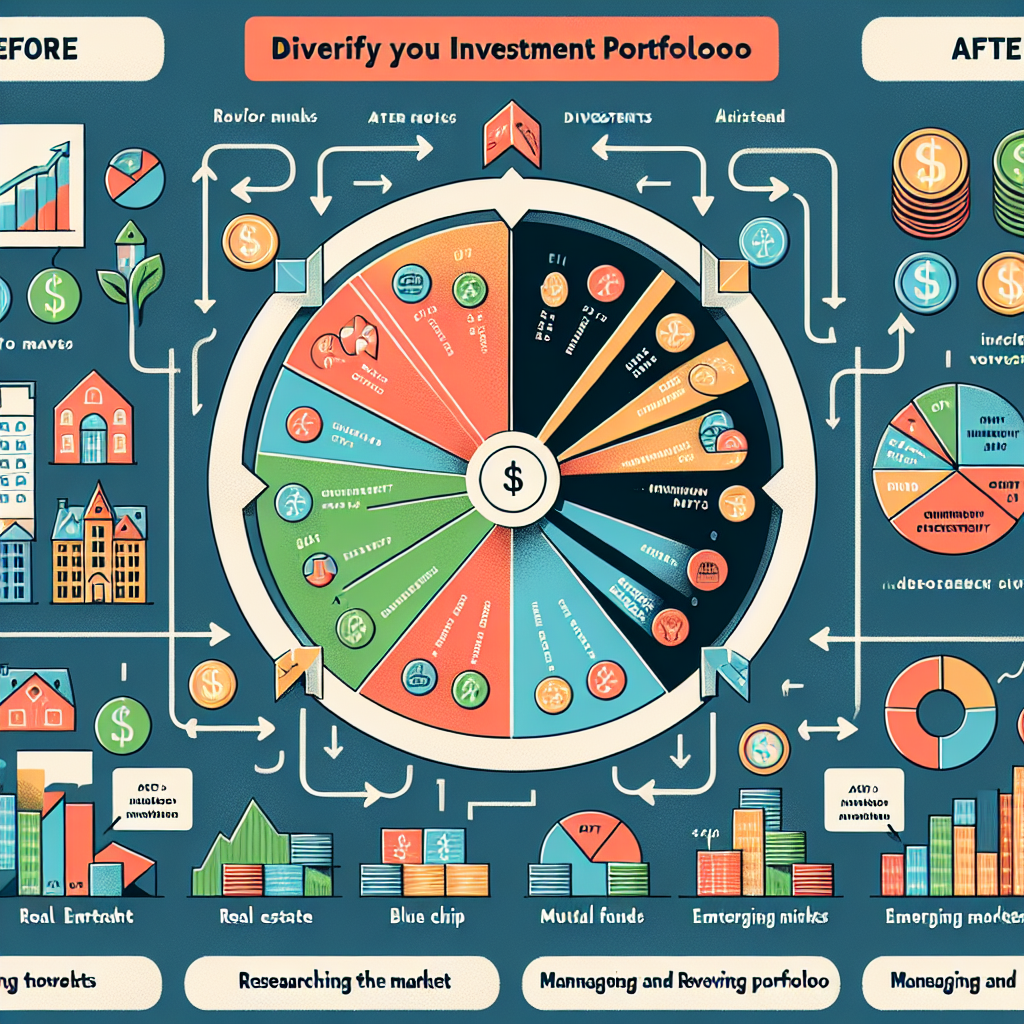

Diversifying your investment portfolio is a crucial strategy for managing risk and aiming for long-term financial growth. It involves spreading your investments across various asset classes, sectors, and geographical locations to reduce the impact of poor performance in any single area. Understanding how to effectively diversify your portfolio can help you mitigate losses during market volatility and capitalize on growth opportunities across the investment spectrum.

Understanding the Basics of Diversification

At its core, diversification is about not putting all your eggs in one basket. When one market sector or asset class experiences a downturn, another might be increasing in value, which can help offset losses. Diversification can smooth out overall investment returns and is a vital component of reaching long-term financial goals while minimizing risk.

Steps to Diversify Your Investment Portfolio

Step 1: Evaluate Your Current Portfolio

Begin by assessing your existing investments. Look at your asset allocation—how your investments are spread across different asset classes like stocks, bonds, real estate, and cash. Identifying any concentrations in specific sectors or companies is crucial to understanding your current level of diversification.

Step 2: Determine Your Investment Goals and Risk Tolerance

Your financial goals, timeline, and risk tolerance play pivotal roles in shaping your diversification strategy. Short-term goals may require a more conservative approach, while long-term goals might allow for taking on more risk with the potential for higher returns. Understanding your comfort level with market fluctuations can help you decide how to distribute your investments among various asset classes.

Step 3: Include a Variety of Asset Classes

Incorporating a mix of stocks, bonds, real estate, and potentially other assets like commodities or cryptocurrency, can offer various levels of risk and return. Each asset class reacts differently to market conditions. Balancing your investment across these classes can significantly reduce risk.

Step 4: Diversify Within Asset Classes

Further diversification within each asset class enhances your risk management. For stocks, this means spreading your investments across different sectors (technology, healthcare, finance, etc.) and market capitalizations (mix of large-cap, mid-cap, and small-cap). For bonds, it involves varying maturities, issuers, and credit qualities.

Step 5: Consider International Exposure

Add a global dimension to your portfolio. Investing in international markets can provide growth opportunities and hedge against domestic market volatility. It’s essential, however, to be aware of the risks associated with currency fluctuations and geopolitical events.

Step 6: Regularly Review and Rebalance Your Portfolio

Market movements can alter your asset allocation over time, potentially skewing your portfolio away from your intended risk level and investment strategy. Periodically reviewing your portfolio and rebalancing it to align with your goals ensures that your diversification strategy remains effective over time.

Conclusion: The Importance of a Diversified Investment Portfolio

Diversifying your investment portfolio is a dynamic process that requires continuous attention. As markets evolve and your financial goals change, so too should your diversification strategy. By spreading your investments across various asset classes and keeping a global perspective, you can protect against significant losses and position your portfolio for balanced growth. Remember, diversification does not guarantee profits or protect against all losses, but it is a proven strategy to manage risk and improve the potential for returns over the long term.