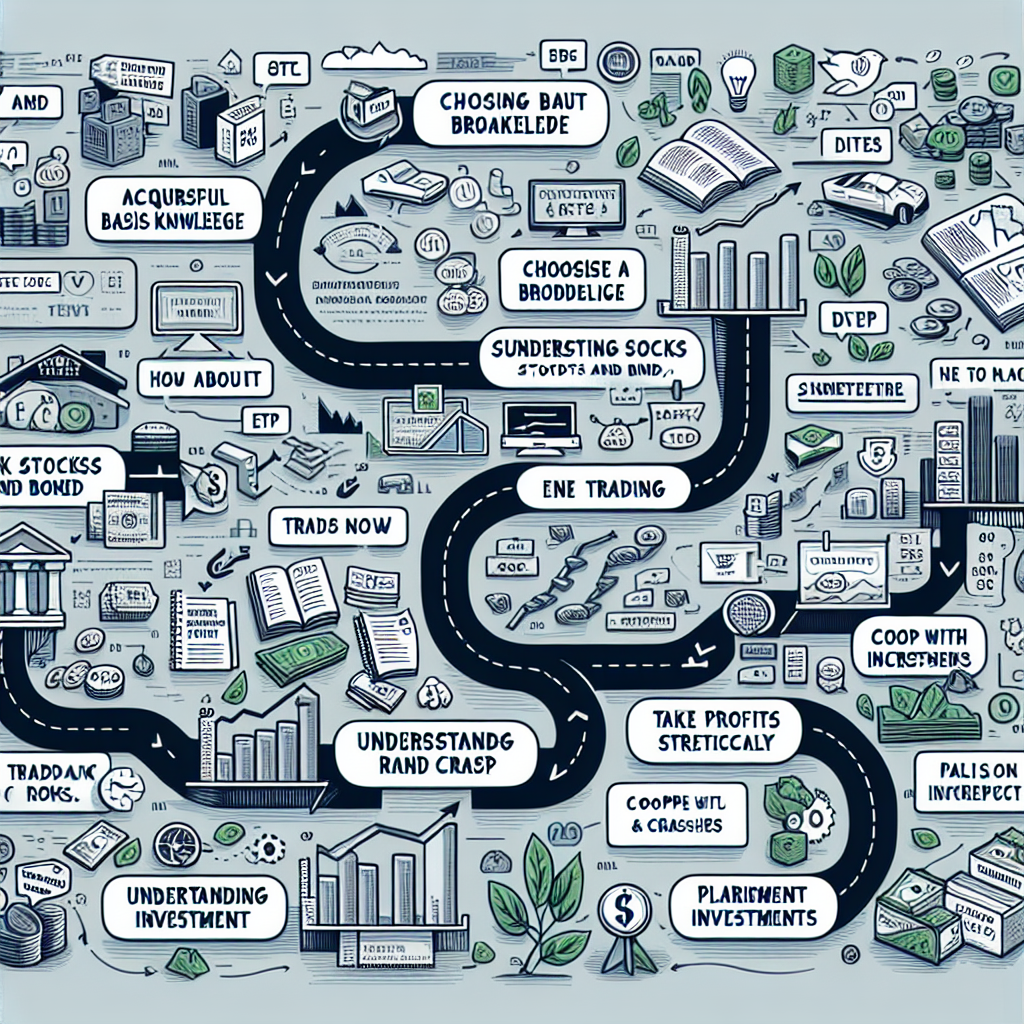

# How to Start Investing in the Stock Market

Investing in the stock market is a strong strategy to build your wealth over time. For beginners, though, the prospect might seem daunting. Here’s a simple guide to help you get started with investing in stocks.

Understanding the Basics

Before diving in, it’s crucial to have a foundational understanding of what stocks are and how the stock market operates. Stocks represent ownership in a company. When you buy a stock, you’re buying a small piece of that company, known as a share. The stock market is where these shares are bought and sold. Prices fluctuate based on supply and demand, influenced by the company’s performance, the economy, and investor sentiment.

Setting Your Investment Goals

Define Your Financial Goals

Begin by asking yourself why you want to invest and what you hope to achieve. Are you saving for retirement, a home, education, or generating passive income? Your investment strategy will vary based on your goals.

Assess Your Risk Tolerance

All investments come with some level of risk. Stocks, for instance, can offer high returns but are subject to market volatility. It’s important to understand your risk tolerance or how much fluctuation in your investment value you can comfortably withstand.

Getting Started with Investing

1. Educate Yourself

Before investing your money, invest your time in learning. There are numerous resources available online, including courses, financial news, and stock market simulations that can offer valuable insights.

2. Choose the Right Investment Account

For most investors, opening a brokerage account is the first step. You have the option between full-service brokers, which provide comprehensive services including advice and portfolio management, and discount brokers, which offer a platform for you to trade stocks without providing personalized advice.

3. Start Small

You don’t need a large sum of money to start investing. Many online brokerage accounts have low or no minimum investment requirements. It’s often recommended to start small, especially if you’re learning.

4. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversification involves spreading your investments across various assets (stocks, bonds, real estate, etc.) to reduce risk.

Building Your Strategy

Choosing Stocks

When selecting stocks, consider the company’s financial health, business model, industry position, and potential for growth. Many investors use a mix of fundamental analysis (examining financial data) and technical analysis (analyzing stock charts) to make informed decisions.

Long-Term vs. Short-Term Investment

Decide if you want to invest for the long term or if you’re looking to trade more frequently. Long-term investments are typically held for years and can provide the benefit of compound interest, while short-term investments aim to capitalize on market fluctuations.

Staying Informed and Adjusting Your Strategy

The stock market is dynamic, and economic conditions can change. Stay informed by following financial news and market trends. As your financial situation or goals change, be prepared to adjust your investment strategy accordingly.

Remember, investing in the stock market requires patience and discipline. There might be times when your investments lose value, but historically, the stock market has provided favorable returns over the long term. Start with a solid foundation of knowledge, build a diversified portfolio tailored to your risk tolerance and financial goals, and stay committed to your long-term strategy.