Understanding Trend Line Drawing Methods

In trading and technical analysis, trend lines are vital tools used by traders to assess the direction and strength of market trends. A well-drawn trend line can provide insights into potential market reversals, support and resistance levels, and guide in making trading decisions. This article explores various trend line drawing methods that can enhance your trading strategy.

What is a Trend Line?

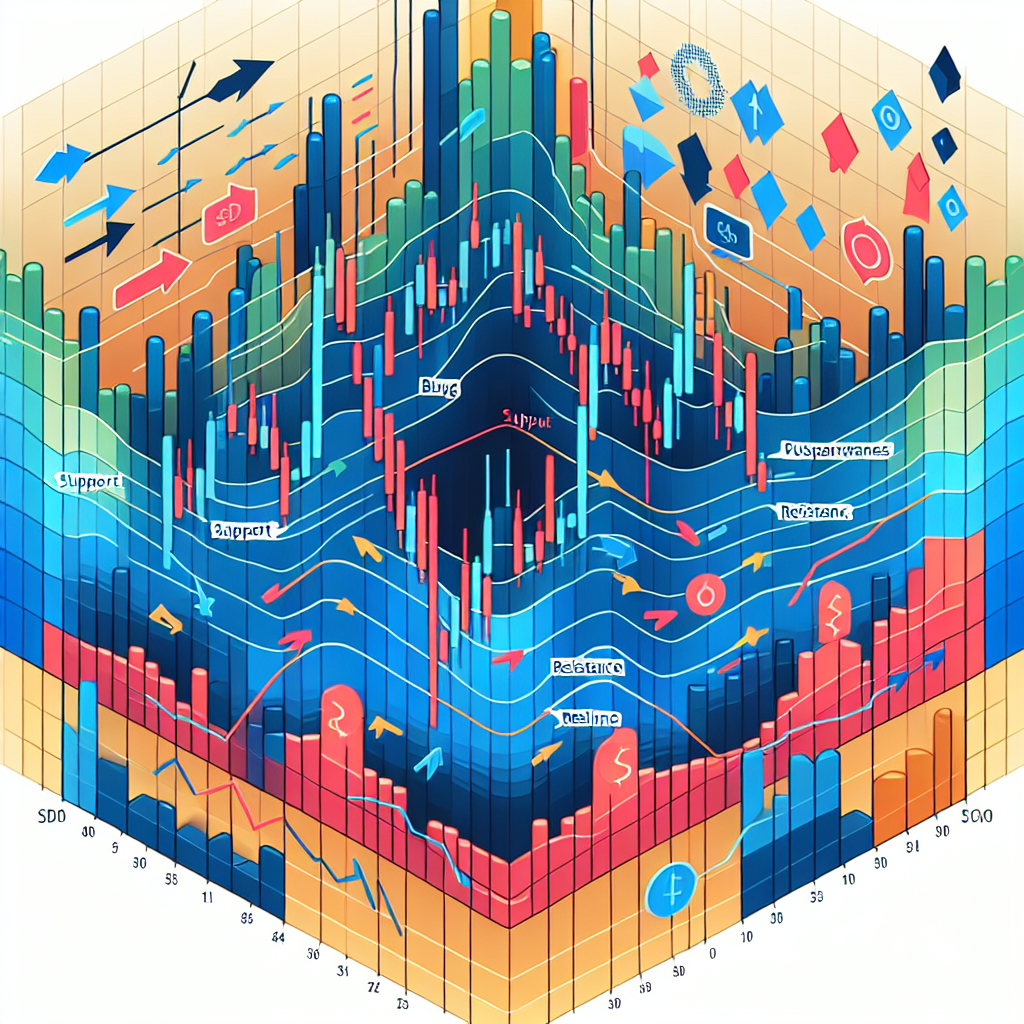

A trend line is a straight line that connects two or more price points and extends into the future to act as a line of support or resistance. There are two main types of trend lines: the uptrend line and the downtrend line. An uptrend line is drawn along the swing lows of price action, indicating support, while a downtrend line is drawn along the swing highs, indicating resistance.

Basic Principles of Drawing Trend Lines

Before delving into specific methods, it’s crucial to understand some basic principles of trend line drawing:

–

Select Relevant Points

Choose significant highs or lows for drawing trend lines. The more points a line touches, the more significant it becomes.

–

Account for the Angle

The angle of a trend line can indicate the market’s strength. Steeper trend lines may not be as sustainable as those with a gentler slope.

–

Adjustment and Redraw

Trend lines are not static; they should be adjusted as new price data becomes available.

Method 1: Manual Drawing

The most straightforward method of drawing trend lines involves manually plotting them on a chart.

–

Step 1: Identify the Trend

First, identify the overall trend direction, whether it’s an uptrend or downtrend.

–

Step 2: Connect Swing Points

For an uptrend, connect at least two major swing lows with a straight line. For a downtrend, connect at least two major swing highs.

–

Step 3: Extend the Line

Extend the line into the future to provide a visual guide for potential support or resistance areas.

Method 2: Using Technical Tools

Many trading platforms offer technical tools to simplify trend line drawing.

–

Trend Line Tool

Use the platform’s trend line tool to click and drag between two or more significant points. The tool automatically draws a straight line that can be extended.

–

Channel Tools

For parallel trend lines, channel tools like Equidistant channels or Fibonacci channels can help by providing a set of lines based on your initial trend line drawing.

Method 3: Mathematical Approaches

For those looking for precision, mathematical methods can be applied to draw trend lines based on formulas and algorithms.

–

Linear Regression

This method uses statistical techniques to fit a straight line that best represents the data points. It’s useful for identifying the central tendency of the trend.

–

Moving Averages

Although not straight lines, moving averages smooth out price data to identify a trend direction. A moving average can act as a dynamic trend line.

Conclusion

Drawing trend lines is both an art and a science, requiring practice and patience. Whether you prefer a manual approach or rely on technical tools and mathematical methods, the key is consistency. By applying these trend line drawing methods, traders can develop a more informed and effective trading strategy.