Introduction to Dow Theory

Dow Theory is one of the earliest forms of technical analysis used in market forecasting. It was conceived by Charles H. Dow, the founder of The Wall Street Journal and the creator of the Dow Jones Industrial Average. Although Dow himself never formally presented his theories, they were later compiled and expounded upon by William Peter Hamilton, Robert Rhea, and E. George Schaefer. Dow Theory focuses on the movements of the Dow Jones Industrial and Transportation averages as a means to decipher the general health of the market and forecast future trends.

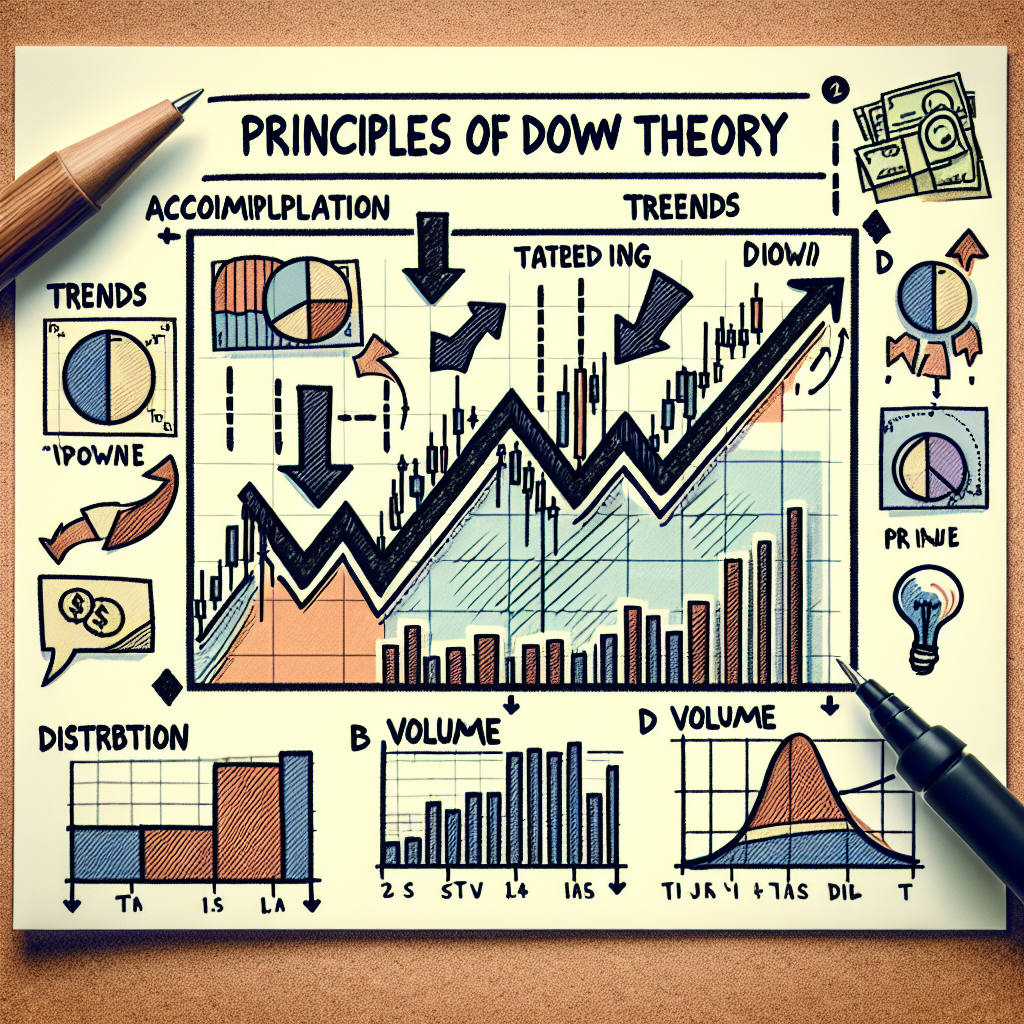

Key Principles of Dow Theory

Dow Theory is built upon six fundamental principles that serve as the cornerstone for market analysis and forecasting. Understanding these principles is crucial for applying Dow Theory effectively.

The Market Discount Everything

This principle posits that all publicly available information is already reflected in stock prices. This includes current events, future expectations, and any other news that could affect stock prices.

The Market Has Three Trends

According to Dow Theory, there are three types of market trends: Primary (major trends), Secondary (corrections or reactions to the primary), and Tertiary (short swings). Recognizing these trends is vital for predicting market direction.

Primary Trends Have Three Phases

The concept here is that primary trends consist of three phases: the accumulation phase, the public participation (or big move) phase, and the distribution phase. Identifying these phases helps investors understand the current market cycle.

The Indices Must Confirm Each Other

Dow Theory contends that for a market trend to be valid, both the industrial and transportation averages should confirm each other. If one average advances while the other does not, it could indicate a potential weakness in the market.

Volume Must Confirm the Trend

Volume is an important factor in confirming the strength of a trend. Dow Theorists believe that volume should increase in the direction of the primary trend and decrease during pullbacks in a bull market, while the opposite is expected in a bear market.

Trends Persist Until a Clear Reversal Occurs

Finally, Dow Theory suggests that a trend remains in effect until a clear and definitive reversal occurs. It emphasizes the significance of distinguishing between normal market corrections and actual trend reversals.

Applying Dow Theory in Market Forecasting

The application of Dow Theory requires careful analysis of market trends and volumes, alongside the confirmation of both indices. Here is how to apply it:

Analyzing Market Trends

The first step is to identify the current primary trend and its phase. This involves looking at long-term charts of the indices and noting their highs and lows.

Volume Analysis

Next, analyze the trading volume to confirm the strength of the trend. An increase in volume alongside the primary trend direction strengthens the validity of the trend, while decreasing volume suggests weakness.

Watching for Confirmations

Compare the movement of the Dow Jones Industrial and Transportation averages. Both should be moving in the same direction to confirm a true market trend.

Identifying Reversal Patterns

Lastly, be vigilant for any patterns or signals that may indicate a trend reversal. This requires constant monitoring of market news, volume, and price action.

Conclusion

Dow Theory remains a cornerstone of technical market analysis and forecasting. While it may not predict market movements with absolute certainty, it provides a robust framework for understanding market trends and making informed investment decisions. Like all forms of market analysis, Dow Theory should be used in conjunction with other methods to formulate a comprehensive market view.