Fibonacci Trading with Extensions

What is Fibonacci Trading?

Fibonacci trading is a method of technical analysis used by traders to predict potential support and resistance levels in the financial markets. It is based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, etc.).

Using Fibonacci Extensions

While Fibonacci retracement levels are commonly used in trading, Fibonacci extensions can also be a powerful tool for traders. Fibonacci extensions are used to predict potential price targets or levels of resistance beyond the usual retracement levels.

How to Use Fibonacci Extensions in Trading

- Identify a significant price move: Look for a strong trend or impulse move in the price action.

- Draw Fibonacci retracement levels: Use the Fibonacci tool to draw retracement levels from the start to the end of the significant price move.

- Identify potential extension levels: Look for potential extension levels beyond the 100% retracement level, such as 127.2%, 161.8%, 200%, or even 261.8%.

- Set price targets: Use the extension levels to set price targets for potential profit-taking or stop-loss orders.

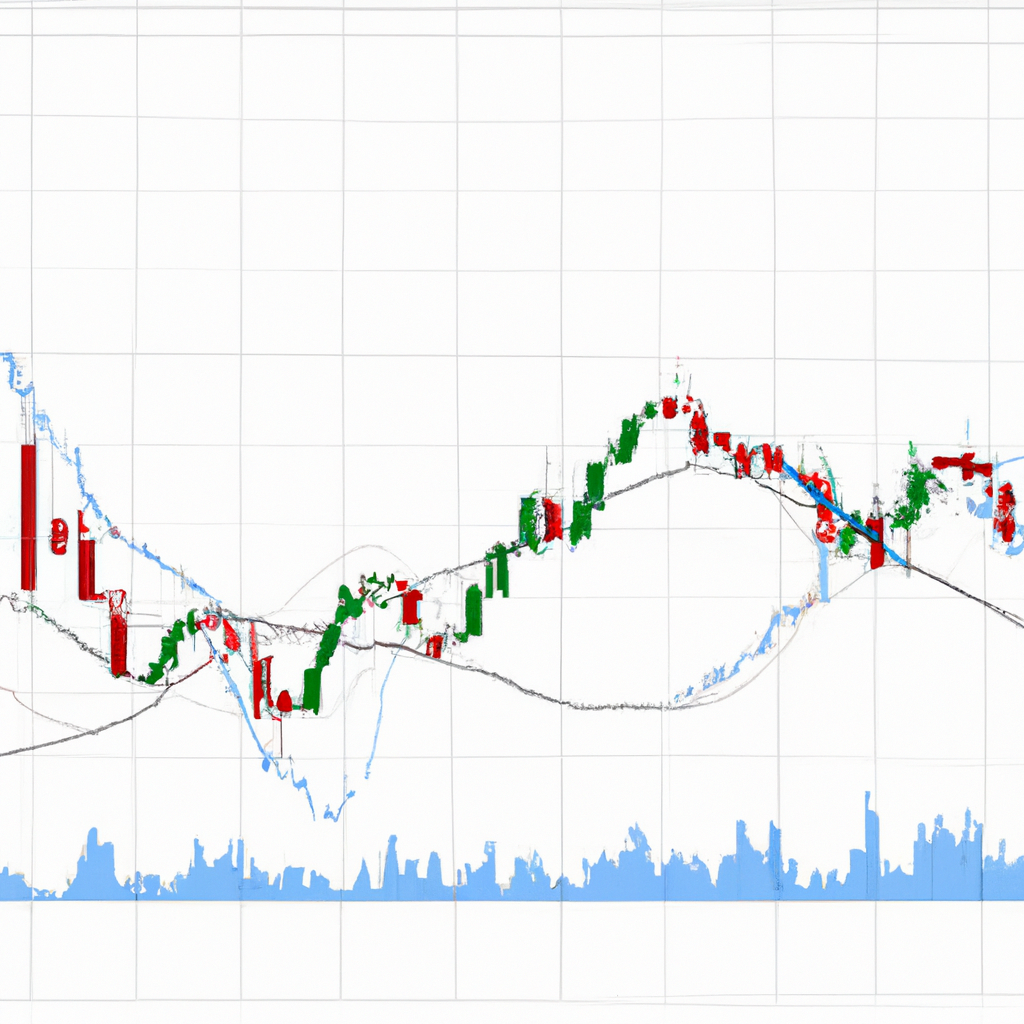

Example of Fibonacci Extensions

For example, if a stock price has a significant uptrend and retraces to the 50% level, a trader can use Fibonacci extensions to set potential price targets for the next leg up. The 127.2% extension level could be used as a conservative target, while the 161.8% or 200% levels could be used for more aggressive targets.

Benefits of Fibonacci Extensions

Using Fibonacci extensions in trading can help traders identify potential price targets and levels of resistance beyond the usual retracement levels. This can help traders make more informed decisions about when to enter or exit trades, as well as where to set profit targets or stop-loss orders.

Conclusion

While Fibonacci retracement levels are commonly used in trading, Fibonacci extensions can also be a valuable tool for traders looking to predict potential price targets or levels of resistance. By using Fibonacci extensions in conjunction with retracement levels, traders can gain a better understanding of the market and make more informed trading decisions.