# Elliott Wave Analysis Methods: A Comprehensive Guide

Elliott Wave analysis is a powerful tool for predicting market trends by identifying recurring long-term price patterns related to investor psychology. Developed by Ralph Nelson Elliott in the 1930s, this methodology is utilized by thousands of traders to improve their trading strategy. This guide offers an in-depth look at the core components and steps involved in applying Elliott Wave analysis methods to your trading.

Understanding the Basics of Elliott Wave Theory

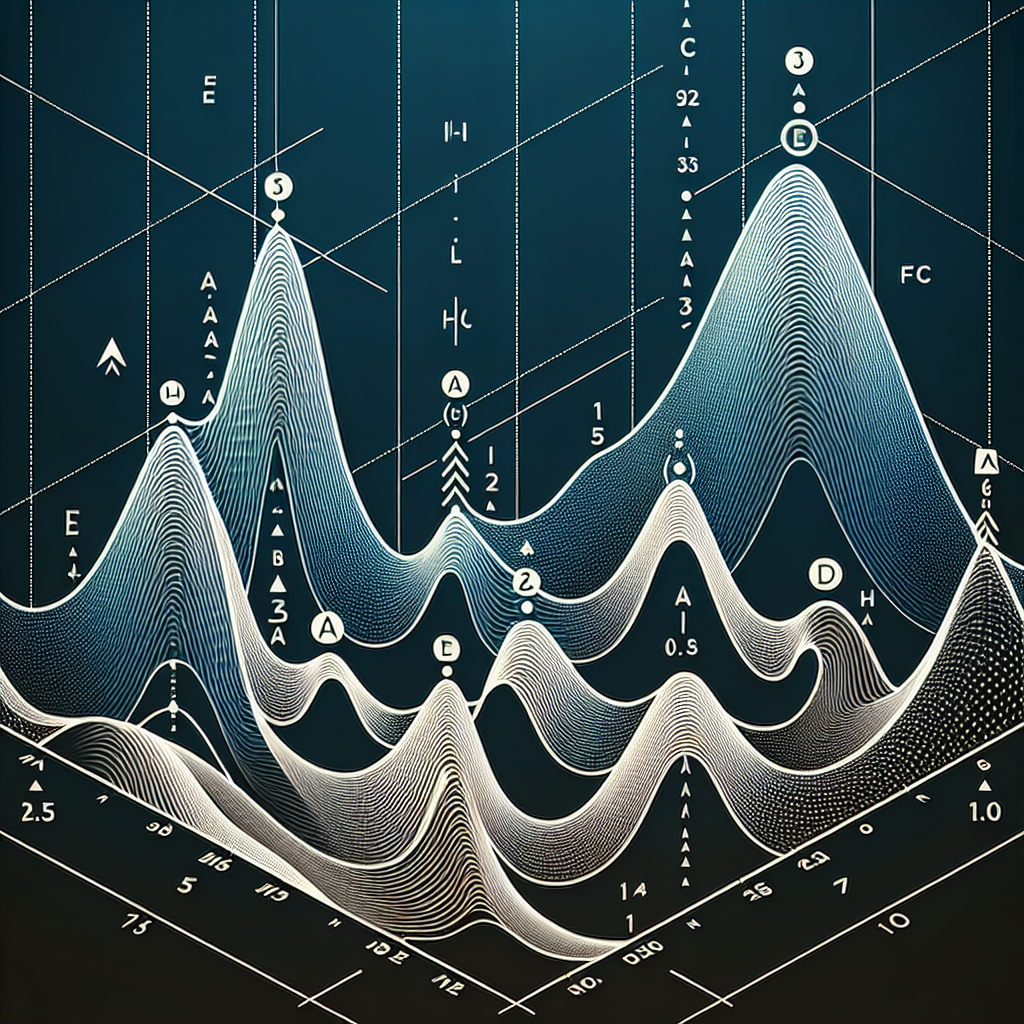

The cornerstone of Elliott Wave analysis is the belief that market movements follow natural and predictable rhythms. Elliott identified that these movements occur in repetitive cycles, which he called “waves.” According to his theory, an upward trend comprises five waves (three up waves and two down waves), which he referred to as an “impulse wave,” followed by a three-wave corrective sequence (one down wave, one up wave, and another down wave) known as a “corrective wave.”

Identifying Wave Patterns

To successfully apply Elliott Wave analysis, the first step is identifying these wave patterns within market price data. Traders analyze charts to pinpoint where the market is currently positioned within these eight-wave cycles and estimate future market movements accordingly.

Impulse Waves

Impulse waves propel the market in the direction of the primary trend. They consist of five smaller waves: three motive waves moving in the trend’s direction, interspersed with two corrective waves against the trend.

Corrective Waves

Corrective waves occur in opposition to the trend and are comprised of three smaller waves: an initial corrective wave, a retraction, and a final corrective movement. These waves correct the progress made by the preceding impulse waves.

Applying Elliott Wave Analysis in Trading

Using Elliott Wave analysis for trading involves several strategic steps, enabling traders to make educated predictions on future market movements.

Step 1: Market Trend Identification

First, use Elliott Wave analysis to determine the overall market trend. This could involve analyzing long-term charts to identify the dominant wave pattern and trend direction (bullish or bearish).

Step 2: Wave Counting

Once the market trend is established, the next step involves “wave counting.” This refers to the process of identifying the current wave within the larger eight-wave cycle. Accurate wave counting is crucial for making reliable market predictions.

Step 3: Predicting Future Movements

After identifying the current wave, use this information to predict future market movements. For instance, if the market is currently in the third impulse wave, it suggests a continuation of the upward trend, offering a potentially profitable buying opportunity.

Step 4: Risk Management

Finally, effective risk management is imperative when trading with Elliott Wave analysis. Establish stop-loss orders to minimize potential losses if the market moves unexpectedly and contradicts your wave predictions.

Challenges and Considerations

Despite its usefulness, Elliott Wave analysis comes with its challenges. Wave counting can be subjective, and different analysts may interpret wave patterns differently. Additionally, external factors such as news events can disrupt wave patterns, rendering predictions inaccurate.

Overcoming Subjectivity

To combat subjectivity in wave counting, many traders combine Elliott Wave analysis with other technical indicators (like moving averages or RSI) to validate their predictions.

Staying Informed

Staying informed about global events and market news is crucial. Unexpected events can lead to sudden market movements, affecting wave patterns. Accordingly, Elliott Wave analysts must remain adaptable and ready to adjust their wave counts and trading strategies.

Conclusion

Elliott Wave analysis is a potent tool for forecasting market trends, offering traders insights into future market movements. By understanding and applying the principles of wave patterns, traders can enhance their trading strategies, making informed decisions based on the natural rhythms of market psychology. However, success with Elliott Wave analysis requires practice, patience, and a comprehensive risk management strategy to mitigate the challenges posed by market volatility and wave pattern subjectivity.