Brokers Supporting Smart Order Routing

Smart order routing (SOR) is a technology used by brokers to automatically split and route orders to different trading venues in order to achieve the best possible execution for their clients. By using SOR, brokers can access multiple liquidity pools and optimize trade execution to minimize market impact and maximize price improvement.

How Brokers Support Smart Order Routing

Brokers support smart order routing by leveraging sophisticated algorithms and technology to analyze market conditions, liquidity, and order flow in real-time. Here are some ways brokers support smart order routing:

- Integration with multiple trading venues: Brokers connect to various trading venues such as exchanges, dark pools, and alternative trading systems to access liquidity from different sources.

- Algorithmic trading strategies: Brokers use advanced algorithms to determine the best way to execute orders based on factors like price, volume, and market conditions.

- Real-time monitoring: Brokers continuously monitor market data and order flow to adjust their routing strategies and ensure optimal execution.

- Customization options: Brokers offer clients the ability to customize their SOR preferences based on their trading goals and risk tolerance.

Benefits of Brokers Supporting Smart Order Routing

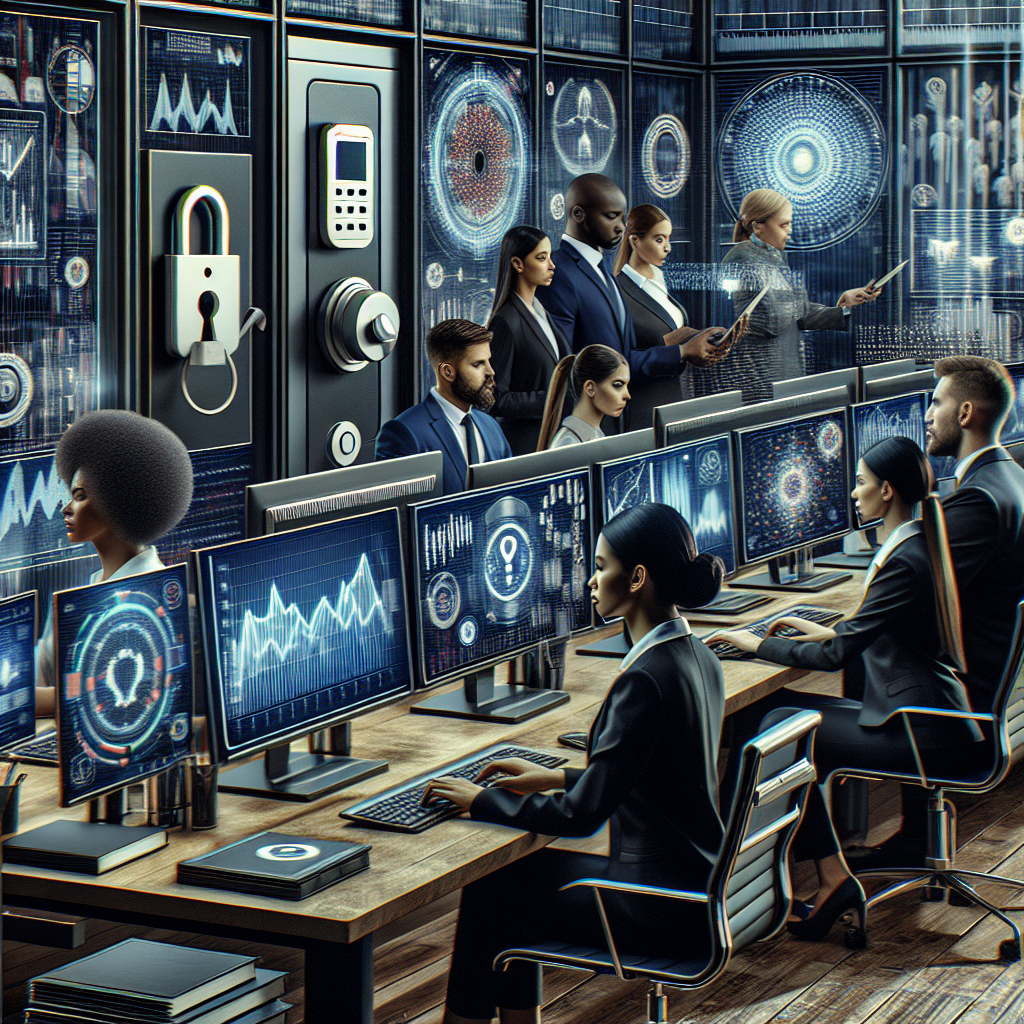

There are several benefits to using brokers that support smart order routing:

- Improved execution quality: By accessing multiple liquidity pools and using advanced algorithms, brokers can achieve better execution prices and reduce trading costs for clients.

- Increased transparency: Brokers provide clients with detailed reports and analytics on order execution, allowing them to track performance and make informed decisions.

- Efficient order handling: Brokers can handle large orders more efficiently by splitting them into smaller chunks and routing them to different venues to minimize market impact.

- Enhanced risk management: Brokers can help clients manage risk by offering tools like stop-loss orders and price alerts to protect against adverse market movements.

Conclusion

Brokers that support smart order routing play a crucial role in helping clients achieve optimal trade execution and maximize returns. By leveraging advanced technology and algorithms, brokers can navigate complex market conditions and deliver superior performance for their clients. As the financial markets continue to evolve, brokers will need to stay ahead of the curve by investing in innovative solutions that enhance their SOR capabilities and provide value to their clients.