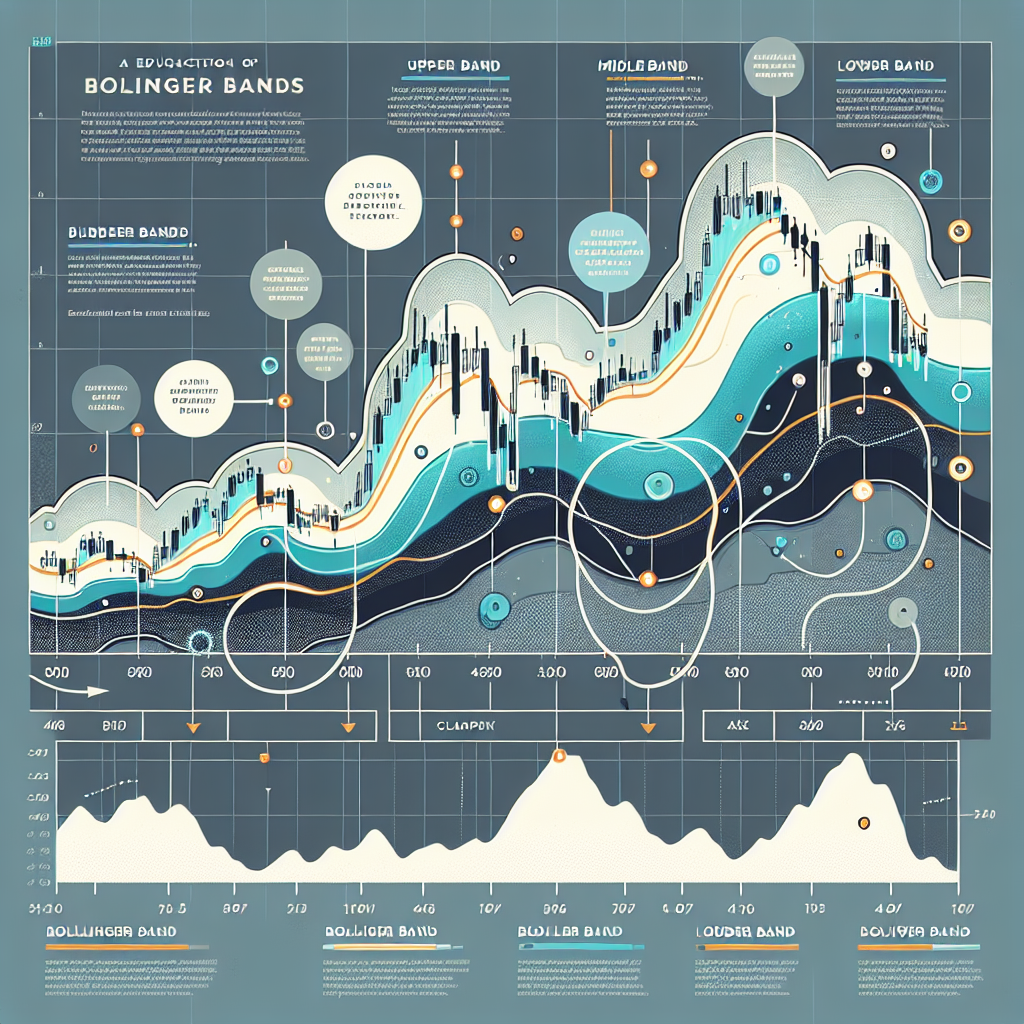

Introduction to Bollinger Bands

Bollinger Bands are a powerful technical analysis tool invented by John Bollinger in the 1980s. This tool is widely used by traders to measure market volatility and identify potential overbought or oversold conditions in the price of an asset. Bollinger Bands consist of three lines: a simple moving average (SMA) in the middle, with two outer bands that are standard deviations away from the SMA. The distance between the upper and lower bands adjusts based on market volatility, with the bands widening during periods of high volatility and contracting during periods of low volatility.

Setting Up Bollinger Bands

Before you can apply Bollinger Bands to your trading strategy, you first need to understand how to set them up on your charting software. Most platforms will allow you to customize the settings, but the standard setup includes:

Period

The typical setting for the SMA period is 20 days, but this can be adjusted based on your trading strategy and the time frame you are analyzing.

Standard Deviations

The standard deviation settings for the upper and lower bands are usually set to 2. This means the bands are calculated two standard deviations above and below the SMA. Adjustments can be made depending on your risk tolerance and the asset’s volatility.

Price Type

While the closing price is commonly used in the calculation of the SMA within Bollinger Bands, some traders may choose to use open, high, or low prices based on their trading preferences.

Trading Strategies Using Bollinger Bands

Bollinger Bands can be used in various trading strategies to help traders make informed decisions. Below are some of the most common strategies:

Trend Following

When the price moves closer to the upper band, it indicates that the asset is possibly overbought and may be setting up for a pullback or reversal. Conversely, when the price moves closer to the lower band, the asset is possibly oversold and could be gearing up for a bounce back. Traders might enter a buy position as the price touches the lower band and consider selling or shorting as it reaches the upper band.

Bollinger Band Squeeze

A Bollinger Band squeeze occurs when the bands contract and move closer together, suggesting a drop in market volatility. This often precedes a significant price move. Traders watch for a breakout from the squeeze, which might indicate the beginning of a strong trend.

Reversals with Bollinger Bands

Another strategy involves looking for price tops or bottoms that occur outside the Bollinger Bands followed by a subsequent top or bottom inside the bands. This pattern can indicate a potential reversal in the current trend.

Considerations and Tips for Using Bollinger Bands

While Bollinger Bands can be an invaluable tool in a trader’s arsenal, there are several important considerations to keep in mind:

Market Conditions

Bollinger Bands are most effective in markets that demonstrate significant volatility. In very flat or trendless markets, the bands may produce many false signals.

Complementary Indicators

It’s often beneficial to use Bollinger Bands in conjunction with other indicators, such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence), to confirm signals and reduce the number of false positives.

Risk Management

Always employ sound risk management practices. This includes setting stop losses to protect your investment from significant losses and ensuring that you’re not overexposed to a single asset.

Conclusion

Bollinger Bands are a versatile tool that can help traders gauge market volatility, identify potential entry and exit points, and make informed decisions. By understanding how to properly set up and apply Bollinger Bands, along with employing a disciplined trading and risk management strategy, traders can enhance their ability to succeed in various market conditions.