Trading with Harmonic Patterns

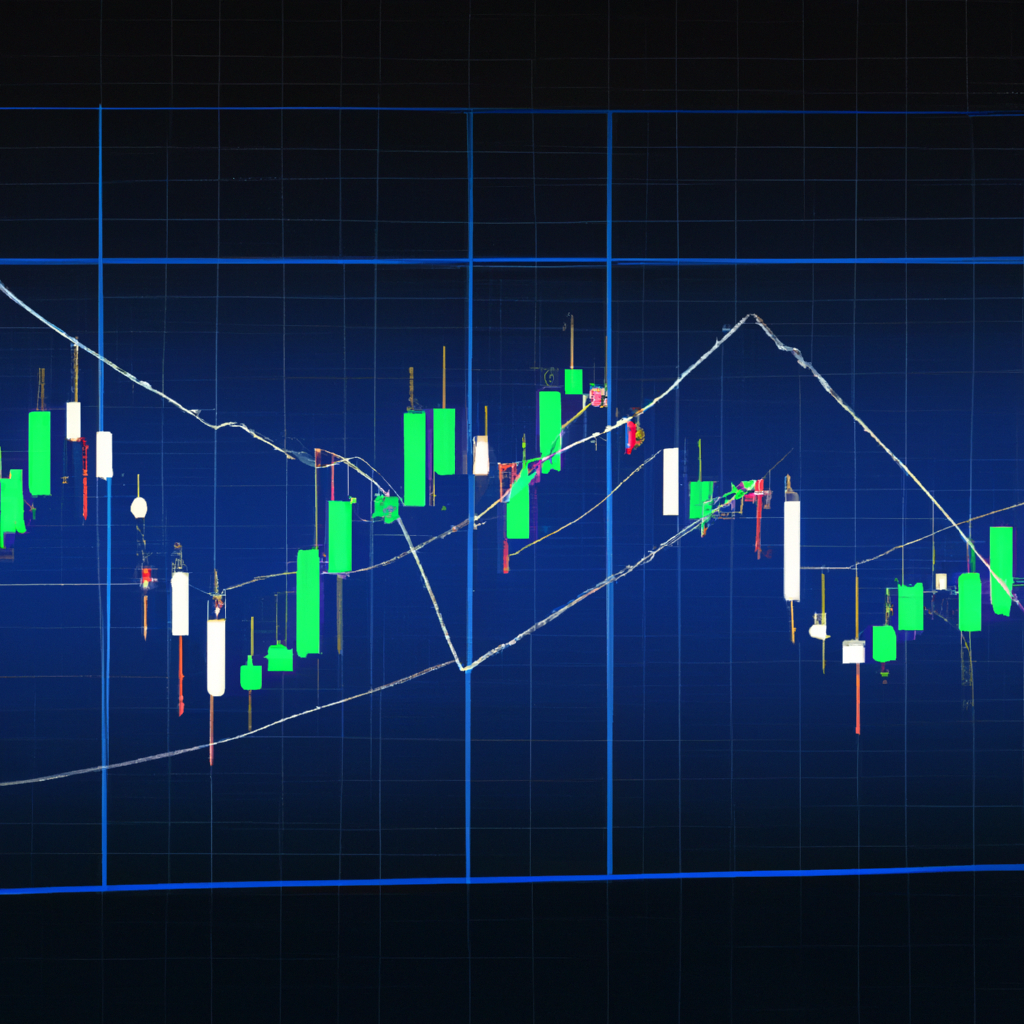

Harmonic patterns are a popular technical analysis tool used by traders to identify potential reversal points in the market. These patterns are based on Fibonacci levels and geometric shapes that repeat themselves in the financial markets. By recognizing these patterns, traders can anticipate where the price is likely to change direction, allowing them to enter or exit trades at optimal levels.

Identifying Harmonic Patterns

There are several types of harmonic patterns that traders can look for, including the Gartley, Butterfly, Bat, and Crab patterns. Each pattern has specific ratios and rules that need to be met in order to be valid. Traders can use specialized tools or manually identify these patterns on price charts.

Trading Strategies with Harmonic Patterns

Once a harmonic pattern has been identified, traders can use it to plan their trades. One common strategy is to enter a trade at the completion point of the pattern, with a stop loss placed just beyond the pattern’s reversal point. This allows traders to limit their risk while maximizing their potential profits if the trade goes in their favor.

Another strategy is to use harmonic patterns in conjunction with other technical indicators or analysis techniques. By combining harmonic patterns with tools such as moving averages, trendlines, or support and resistance levels, traders can increase the probability of a successful trade.

Risk Management

As with any trading strategy, risk management is crucial when trading with harmonic patterns. Traders should always use stop-loss orders to protect their capital and limit their losses. Additionally, it’s important to only risk a small percentage of your trading account on each trade, in order to preserve capital and avoid large drawdowns.

Conclusion

Trading with harmonic patterns can be a profitable strategy for traders who are able to accurately identify and interpret these patterns. By understanding the principles behind harmonic patterns and implementing proper risk management techniques, traders can increase their chances of success in the financial markets.