# The Magic of Fibonacci Extensions in Trading

Trading revolves around making educated guesses about market movement. Among the plethora of tools at a trader’s disposal, Fibonacci Extensions stand out for their ability to forecast potential price targets. This article dives into what Fibonacci Extensions are, how to calculate them, and their application in trading strategies.

Understanding Fibonacci Extensions

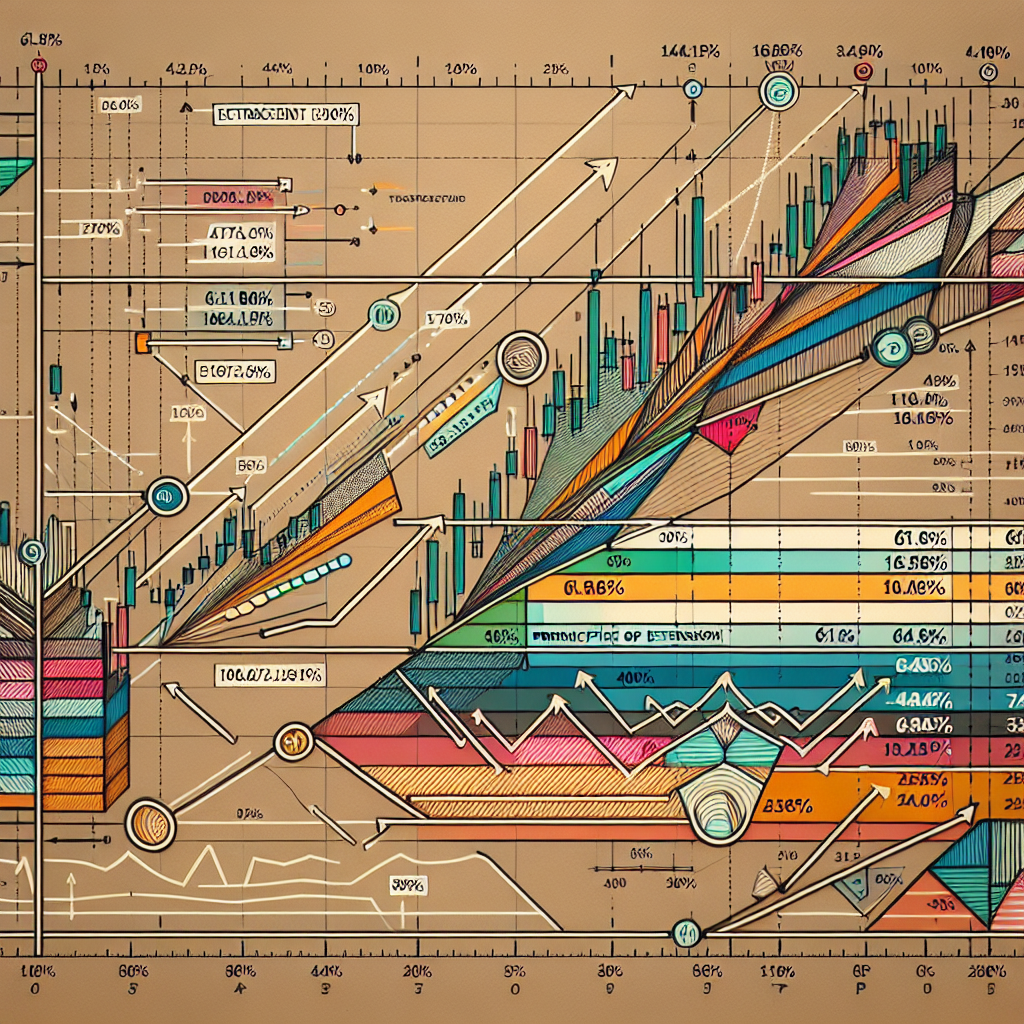

Fibonacci Extensions are a tool used in financial markets to predict potential areas of support or resistance in the future, based on previous price movements. They are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, 21, …). This sequence generates ratios, and in the context of trading, the most significant ones are 61.8%, 100%, 161.8%, and 261.8%, which traders apply to identify potential price targets.

Calculating Fibonacci Extensions

Calculating Fibonacci Extensions involves identifying three critical points in a price chart: the high point, the low point, and the end of the retracement. The difference between the high and low points is calculated and then multiplied by the Fibonacci ratios to determine how far past the high point (in an uptrend) or how far below the low point (in a downtrend) the price might go.

Step 1: Identify the Main Move

You need to determine the most recent significant move in the price. This involves finding the recent high and low points.

Step 2: Determine the Retracement Point

The retracement point is where the price action pulls back or retraces to before attempting to continue in the original direction. This point is your setup for applying Fibonacci Extensions.

Step 3: Apply Extensions

Using a Fibonacci Extension tool available in most trading platforms, you set your 0% level at the start of the main move, 100% level at the end of the main move, and then extend the lines beyond 100% to 161.8%, 261.8%, etc., to predict potential future price targets.

Using Fibonacci Extensions in Trading Strategies

Fibonacci Extensions can be a powerful addition to a trader’s toolkit when used in combination with other indicators to validate trade signals.

Identifying Profit Targets

Traders often use Fibonacci Extensions to set profit targets. For instance, if entering a trade at the end of a retracement, the 161.8% or 261.8% extensions could serve as potential take-profit levels.

Stop Loss Placement

While Fibonacci Extensions mainly focus on predicting support and resistance levels to take profits, they can also inform about reasonable levels to set stop losses, especially if the price moves counter to your initial analysis.

Combining with Other Indicators

No tool should be used in isolation for trading decisions. Combining Fibonacci Extensions with other indicators like Moving Averages, RSI, or MACD can provide confluence, boosting the confidence in your trading signals.

Conclusion

Fibonacci Extensions are more than just a mathematical curiosity; they are a testament to the natural order that seems to govern markets just as much as it does natural phenomena. By effectively applying Fibonacci Extensions, traders can enhance their strategy, providing them with a clearer roadmap in the often turbulent journey through the markets. However, as with all trading tools, it’s vital to remember that risk management should never take a backseat.